Hydrogen energy startups are attracting a lot of venture capital funding lately. Over the past four months, companies developing technology for low-emission hydrogen production and distribution have raised more than $1 billion, according to Crunchbase data. This is already more than two-thirds of the total raised in all of last year.

Major Investments

Several early-stage companies have secured significant funding. Last week, Hysata, an Australian company working on electrolyzers (devices that split water into hydrogen and oxygen using electricity), raised $110 million in a Series B round co-led by BP Ventures and Templewater.

A few months earlier, Koloma, a Denver-based startup focusing on geologic hydrogen resources, raised $246 million in a Series B led by Khosla Ventures. This was the largest early-stage round in the hydrogen space.

Consistent Growth

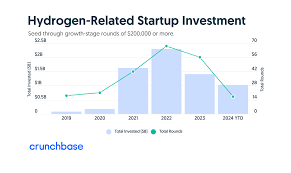

Hydrogen energy investment has continued to grow over the past five years. Unlike many sectors where startup investment peaked in 2021, hydrogen energy saw a high point in 2022 and is on track to exceed that this year.

Top Funded Startups

Using Crunchbase data, we found 13 well-funded startups in the hydrogen energy space that recently raised money. Together, these companies have raised $3.66 billion in equity funding, plus hundreds of millions more in grants and debt financing. Here are some notable ones:

- Electric Hydrogen: This Massachusetts company, called the green hydrogen industry’s first unicorn, raised $380 million in a Series C round in October. They manufacture electrolyzers that produce hydrogen at the lowest cost available.

- HysetCo: Based in France, HysetCo operates a network of hydrogen distribution stations and mobility services. In April, they raised $216 million led by Hy24. They distribute nearly 30 tons of hydrogen monthly and manage a fleet of over 500 hydrogen vehicles.

- Tree Energy Solutions: This Brussels-based company raised $150 million in an April Series C. They use renewable energy to produce green hydrogen and combine it with recycled CO₂ to create electric natural gas (e-NG).

- ZeroAvia: This California company develops hydrogen-electric engines for zero-emission flights. They raised $116 million in a Series C in September, with Airbus as a lead investor, along with United Airlines and Alaska Air Group.

Hydrogen’s Big Moment

While green hydrogen isn’t a new concept, the recent surge in investment shows that investors see the right mix of government incentives, technology advancements, and market readiness to make it a success. Timing is crucial for startup success, and it looks like the moment for low-emission hydrogen is now.